Holiday 2022 PPM Data – Information for the Holiday 2022 sweep has been released for Washington, Boston, Miami, Seattle, Detroit, Phoenix, Minneapolis, San Diego, Tampa, Denver, Baltimore, and St. Louis.

Nielsen Audio’s Holiday 2022 sweep covered December 8 (2022) – January 4 (2023).

TALKERS magazine managing editor Mike Kinosian provides “Takeaways” for spoken-word stations finishing in their respective markets’ top twenty.

Cited as well are each particular city’s #1 station (6+) and loftiest (6+) upticks and drop-offs.

All comparisons noted are December 2022 – “Holiday” 2022 (6+).

WASHINGTON, DC

News/Talk: Cumulus Media’s WMAL “105.9 FM – Where Washington Comes To Talk” 3.5 – 3.4, -.1, eighth to seventh

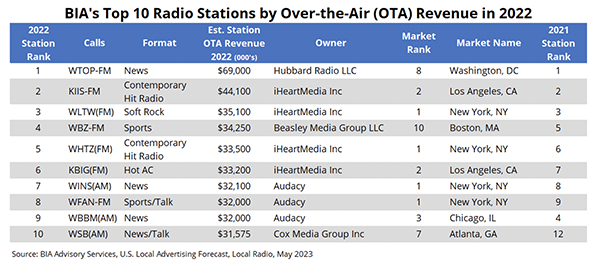

News: Hubbard Broadcasting-owned WTOP & WTLP “Washington’s Top News” 8.6 – 7.8, -.8, repeats in third-place

Sports Talk: Audacy’s WJFK-FM “106.7 The Fan” (Capitals) 2.8 – 2.7, -.1, flat at #14 and WJFK-FM’s internet stream .7 – 1.0, +.3, #21 to #19

Public Radio News/Talk: American University-owned WAMU 11.5 – 11.3, -.2, #1

Number One 6+: public radio news/talk WAMU, 13th month in succession, 11.5 – 11.3, -.2

Largest 6+ December 2022 – “Holiday” 2022 Increase: adult contemporary WASH (+2.0)

Largest 6+ December 2022 – “Holiday” 2022 Decrease (Tie): country WMZQ and classic hits-oldies WIAD (-1.0)

BOSTON

News/Talk: iHeartMedia’s WRKO “AM 680 The Voice Of Boston” 2.7 – 2.8, +.1, #14 to #13

News – Talk: iHeartMedia-owned WBZ-AM “News Radio 1030” 4.7 – 4.8, +.1, fifth to sixth

Sports Talk: Beasley Media Group’s WBZ-FM “98.5 The Sports Hub” (Celtics, Bruins, and New England Patriots) 8.5 – 8.0, -.5, repeats in the runner-up slot

Audacy-owned WEEI-FM “93.7 Boston’s Sports Station” 4.7 – 4.6, -.1, fifth to seventh

Public Radio News/Talk: Boston University’s WBUR 4.2 – 4.6, +.4, eighth to seventh

WGBH Educational Foundation-owned WGBH 4.0 – 3.4, -.6, continues in ninth-place

Number One 6+: Audacy adult contemporary WMJX, second month in a row, 9.7 – 12.5, +2.8

Largest 6+ December 2022 – “Holiday” 2022 Increase: adult contemporary WMJX (+2.8)

Largest 6+ December 2022 – “Holiday” 2022 Decrease (Tie): classic hits-oldies WROR and CHR WXKS-FM (-.8)

MIAMI

News/Talk: None in the top twenty

News: None in the top twenty

Sports Talk: None in the top twenty

Public Radio News/Talk: Dade County School Board-owned WLRN 2.9 – 3.1, +.2, #14 to #13

Number One 6+: Cox Media Group urban AC WHQT, first month, 8.0 – 8.9, +.9

Largest 6+ December 2022 – “Holiday” 2022 Increase: urban AC WHQT (+.9)

Largest 6+ December 2022 – “Holiday” 2022 Decrease: adult contemporary WFEZ (-1.2)

SEATTLE

News/Talk: Bonneville-owned KIRO-FM “97.3 FM” (Seahawks) 6.6 – 5.5, -1.1, second to third

News: Lotus Communications’ KNWN-AM & KNWN-FM “Northwest News Radio” 5.2 – 5.5, +.3, fifth to third

Sports Talk: Bonneville-owned KIRO-AM “710 AM ESPN Seattle” (Seahawks) 3.8 – 3.5, -.3, #11 to #10

Public Radio News/Talk: Northwest Public Radio’s KUOW 4.6 – 4.9, +.3, repeats in sixth-place

Number One 6+: Hubbard Broadcasting adult contemporary KRWM, second month in succession, 10.0 – 11.3, +1.3

Largest 6+ December 2022 – “Holiday” 2022 Increase: adult contemporary KSWD (+2.7)

Largest 6+ December 2022 – “Holiday” 2022 Decrease: news/talk KIRO-FM (-1.1)

DETROIT

News/Talk: Cumulus Media’s WJR “News Talk 760 AM” 2.5 – 2.3, -.2, flat at #15

News: Audacy-owned WWJ News Radio 950” (Pistons) 4.6 – 4.5, -.1, repeats in seventh-place

Sports Talk: Audacy’s WXYT-FM “97.1 The Ticket” (Red Wings and Lions) 7.4 – 7.6, +.2, continues in the runner-up slot and WXYT-FM’s internet stream 2.0 – 2.2, +.2, #18 to #16

Public Radio News/Talk: University of Michigan-owned WUOM 2.4 – 2.2, -.2, #17 to #16

Number One 6+: iHeartMedia adult contemporary WNIC, second month in a row, 11.7 – 15.7, +4.0

Largest 6+ December 2022 – “Holiday” 2022 Increase: adult contemporary WNIC (+4.0)

Largest 6+ December 2022 – “Holiday” 2022 Decrease: rock WRIF (-1.0)

PHOENIX

News/Talk: iHeartMedia’s KFYI “News Talk 550” 3.5 – 3.3, -.2, repeats in eighth-place

News: None in the top twenty

Sports Talk: None in the top twenty

Public Radio News/Talk: Maricopa County Community College-owned KJZZ 7.8 – 8.1, +.3, continues in the runner-up slot

Number One 6+: iHeartMedia adult contemporary KESZ, second consecutive month, 11.3 – 16.7, +5.4

Largest 6+ December 2022 – “Holiday” 2022 Increase: adult contemporary KESZ (+5.4)*

Largest 6+ December 2022 – “Holiday” 2022 Decrease: sports talk KMVP-FM (-1.1)

*Represents a tie for the largest December 2022 – “Holiday” 2022 increase (6+) of any station from these 12 PPM-markets

MINNEAPOLIS

News/Talk: Audacy’s WCCO “News Talk 830” (Minnesota Timberwolves) 4.0 – 3.7, -.3, anchored at #12

Hubbard Broadcasting-owned KTMY “My Talk 107.1” 2.9 – 3.1, +.2, steady at #14

iHeartMedia’s KTLK-AM “Twin Cities News Talk AM 1130” 2.7 – 2.0, -.7, flat at #17

News: None in the top twenty

Sports Talk: iHeartMedia-owned KFXN “FM 100.3 K-Fan” (Minnesota Wild, Minnesota Vikings) unchanged at 7.5, repeats in the runner-up slot

Public Radio News/Talk: Minnesota Public Radio’s KNOW 6.7 – 6.3, -.4, third to fourth

Number One 6+: iHeartMedia classic hits-oldies KQQL, second straight month, 11.4 – 15.0, +3.6

Largest 6+ December 2022 – “Holiday” 2022 Increase: classic hits-oldies KQQL (+3.6)

Largest 6+ December 2022 – “Holiday” 2022 Decrease: adult hits KZJK (-1.4)

SAN DIEGO

News/Talk: iHeartMedia’s KOGO “News Radio 600” 4.6 – 5.4, +.8, sixth to fifth

News: None in the top twenty

Sports Talk: iHeartMedia-owned KGB-AM “San Diego Sports 760” .8 – 1.0, +.2, #21 to #20

Public Radio News/Talk: San Diego State University’s KPBS 6.5 – 5.5, -1.0, third to fourth

Number One 6+: Audacy adult contemporary KYXY, second month in a row, 8.3 – 13.6, +5.3

Largest 6+ December 2022 – “Holiday” 2022 Increase: adult contemporary KYXY (+5.3)

Largest 6+ December 2022 – “Holiday” 2022 Decrease: adult hits KFBG (-2.2)

TAMPA

News/Talk: Cox Media Group’s WHPT “102.5 The Bone – Real, Raw, Radio” (Lightning) 4.8 – 3.7, -1.1, #7 to #12

iHeartMedia-owned WFLA “News Radio 970” steady at 2.2, #18 to #17

News: None in the top twenty

Sports Talk: iHeartMedia-owned WDAE “Tampa Bay’s Sports Radio” 1.9 – 1.5, -.4, anchored at #19

Public Radio News/Talk: University of South Florida’s WUSF unchanged at 2.6, #17 to #15

Number One 6+: Cox Media Group adult contemporary WDUV, 17th month in a row, 8.1 – 11.4, +3.3

Largest 6+ December 2022 – “Holiday” 2022 Increase: adult contemporary WDUV (+3.3)

Largest 6+ December 2022 – “Holiday” 2022 Decrease: news/talk WHPT (-1.1)

DENVER

News/Talk: iHeartMedia-owned KOA “News Radio 850” (Broncos) steady at 2.4, #17 to #16 and cluster-mate KHOW “Talk Radio 630” 1.8 – 1.5, -.3, #19 to #20

News: None in the top twenty

Sports Talk: Bonneville’s KKFN “104.3 The Fan” (Nuggets) 3.4 – 4.0, +.6, #11 to #7

Public Radio News/Talk: Colorado Public Radio-owned KCFR 4.0 – 3.6, -.4, #8 to #11

Number One 6+: Bonneville adult contemporary KOSI, third consecutive month, 9.8 – 14.4, +4.6

Largest 6+ December 2022 – “Holiday” 2022 Increase: adult contemporary KOSI (+4.6)

Largest 6+ December 2022 – “Holiday” 2022 Decrease: hot AC KALC (-2.0)

BALTIMORE

News/Talk: Hearst Television’s WBAL “News Radio 1090 AM & 101.5 FM” (Ravens) 3.5 – 3.6, +.1, ninth to tenth

WCBM Maryland-owned WCBM “Talk Radio AM 680” steady at 1.6, locked at #17

Cumulus Media-owned WMAL “105.9 FM – Where Washington Comes To Talk” .4 – .6, +.2, #25 to #20

News: Audacy-owned business news WDCH “Bloomberg 99.1 FM”.7 – .6, -.1, flat at #20

Sports Talk: Audacy’s WJZ-FM “Baltimore Sports Radio 105.7 The Fan” 4.6 – 4.3, -.3, seventh to sixth

Public Radio News/Talk: Your Public Radio Corporation-owned WYPR 3.1 – 2.9, -.2, #11 to #12

Number One 6+: Audacy adult contemporary WLIF, fifth consecutive month, 11.8 – 14.5, +2.7

Largest 6+ December 2022 – “Holiday” 2022 Increase: adult contemporary WLIF (+2.7)

Largest 6+ December 2022 – “Holiday” 2022 Decrease: adult hits WQSR (-2.5)**

**Represents the largest December 2022 – “Holiday” 2022 decrease (6+) of any station from these 12 PPM-markets

ST. LOUIS

News/Talk: Audacy’s KMOX “The Voice Of St. Louis” 4.0 – 4.4, +.4, #12 to #9 and cluster-mate KFTK “Talk 97.1 FM” 1.6 – 1.4, -.2, #16 to #17

News: None in the top twenty

Sports Talk: Hubbard Broadcasting’s WXOS “101 ESPN” (Blues) 4.2 – 3.7, -.5, flat at #11

Public Radio News/Talk: University of Missouri-owned KWMU 4.3 – 3.6, -.7, #10 to #13

Number One 6+: Audacy adult contemporary KEZK, first month, 9.4 – 14.8, +5.4

Largest 6+ December 2022 – “Holiday” 2022 Increase: adult contemporary KEZK (+5.4)*

Largest 6+ December 2022 – “Holiday” 2022 Decrease: rock KSHE (-1.3)

*Represents a tie for the largest December 2022 – “Holiday” 2022 increase (6+) of any station from these 12 PPM-markets

Up next: “Holiday” 2022 overviews for Portland; Charlotte; San Antonio; Sacramento; Pittsburgh; Salt Lake City; Las Vegas; Orlando; Cincinnati; Cleveland; Kansas City; and Columbus.

Email Mike Kinosian at Mike.Kinosian@gmail.com

Share this with your network

2022. iHeartMedia breaks down its operations into segments and here’s what it reports for the full year of 2023: Broadcast Radio revenue was $1.75 billion (down 7% from 2022), Networks revenue was $466 million (down 7.3%), Podcast revenue was $407.8 million (up 13.8%), and Digital (excluding Podcast) revenue was $661 million (basically flat). iHeartMedia chairman and CEO Bob Pittman states, “We’re pleased to report that our fourth quarter results were in line with our previously provided Adjusted EBITDA and Revenue guidance ranges. This quarter the Digital Audio Group achieved the highest Adjusted EBITDA and margin in its history, illustrating the success of this high growth business. We view 2024 as a recovery year in which the company returns to growth mode – we expect to see our Multiplatform Group performance improve quarter by quarter throughout the year, and we expect our Digital Audio Group, including our industry leading podcast business, to continue to grow and reinforce its leadership position in the segment.”

2022. iHeartMedia breaks down its operations into segments and here’s what it reports for the full year of 2023: Broadcast Radio revenue was $1.75 billion (down 7% from 2022), Networks revenue was $466 million (down 7.3%), Podcast revenue was $407.8 million (up 13.8%), and Digital (excluding Podcast) revenue was $661 million (basically flat). iHeartMedia chairman and CEO Bob Pittman states, “We’re pleased to report that our fourth quarter results were in line with our previously provided Adjusted EBITDA and Revenue guidance ranges. This quarter the Digital Audio Group achieved the highest Adjusted EBITDA and margin in its history, illustrating the success of this high growth business. We view 2024 as a recovery year in which the company returns to growth mode – we expect to see our Multiplatform Group performance improve quarter by quarter throughout the year, and we expect our Digital Audio Group, including our industry leading podcast business, to continue to grow and reinforce its leadership position in the segment.”

Last week, we recapped how all-news stations have recently performed in Nielsen Audio‘s (volatile) “Holiday” PPM survey periods.

Last week, we recapped how all-news stations have recently performed in Nielsen Audio‘s (volatile) “Holiday” PPM survey periods. ongoing challenges related to the economy and softness in the national spot market, Beasley’s successful digital transformation, continued local audio leadership and revenue diversification initiatives, combined with our proactive initiatives to reduce expenses, resulted in net loss declining by more than $4 million in both the quarter and year-to-date periods, compared to the same periods in 2022, as well as quarterly adjusted

ongoing challenges related to the economy and softness in the national spot market, Beasley’s successful digital transformation, continued local audio leadership and revenue diversification initiatives, combined with our proactive initiatives to reduce expenses, resulted in net loss declining by more than $4 million in both the quarter and year-to-date periods, compared to the same periods in 2022, as well as quarterly adjusted  EBITDA growth of 16.8% and 2023 year-to-date Adjusted EBITDA growth of 28.1%. During the quarter, we made additional progress with reducing leverage and strengthening our balance sheet as we repurchased another $3 million of our debt at a discount and lowered quarterly interest expense which support our goal to drive cash flow growth. We are generating cash from operations, and we expect to continue to generate positive cash flow for the full year. Our digital strategy delivered second quarter digital revenue growth of 14.8% year-over-year and accounted for 19.4% of total second quarter revenue. Our digital revenue is primarily derived from our owned and operated assets, with our proprietary content creation driving the largest increase with the best margins and third-party products that come with a higher cost. Our talented sales teams have been able to combine our over-the-air and digital platform offerings to create marketing campaigns and brand solutions that provide great results for our clients. Our continued strong digital revenue growth has moved us to within a few basis points of reaching the bottom end of our goal of digital revenue accounting for 20% to 30% of total revenue and we remain laser focused on this initiative as a means to diversify and complement revenue in a cash flow positive manner.” Beasley reports its total debt as of June 30, 2023 was $287 million.

EBITDA growth of 16.8% and 2023 year-to-date Adjusted EBITDA growth of 28.1%. During the quarter, we made additional progress with reducing leverage and strengthening our balance sheet as we repurchased another $3 million of our debt at a discount and lowered quarterly interest expense which support our goal to drive cash flow growth. We are generating cash from operations, and we expect to continue to generate positive cash flow for the full year. Our digital strategy delivered second quarter digital revenue growth of 14.8% year-over-year and accounted for 19.4% of total second quarter revenue. Our digital revenue is primarily derived from our owned and operated assets, with our proprietary content creation driving the largest increase with the best margins and third-party products that come with a higher cost. Our talented sales teams have been able to combine our over-the-air and digital platform offerings to create marketing campaigns and brand solutions that provide great results for our clients. Our continued strong digital revenue growth has moved us to within a few basis points of reaching the bottom end of our goal of digital revenue accounting for 20% to 30% of total revenue and we remain laser focused on this initiative as a means to diversify and complement revenue in a cash flow positive manner.” Beasley reports its total debt as of June 30, 2023 was $287 million.

quarter to $21.7 million compared to the same period last year. A significant part of the increase in station operating expense for the quarter was due to a $272 thousand increase in our self-insured health care costs and a $446 thousand increase in employee compensation, including payroll taxes at the station level. After a number of years of holding the company’s compensation expenses flat, we decided that adjustments in our employee compensation were warranted in consideration of the economic times and inflationary environment.”

quarter to $21.7 million compared to the same period last year. A significant part of the increase in station operating expense for the quarter was due to a $272 thousand increase in our self-insured health care costs and a $446 thousand increase in employee compensation, including payroll taxes at the station level. After a number of years of holding the company’s compensation expenses flat, we decided that adjustments in our employee compensation were warranted in consideration of the economic times and inflationary environment.”  2021, Townsquare is upbeat about its Digital segment. CEO Bill Wilson says, “I am proud to report that Townsquare’s transformation into a Digital First Local Media Company allowed us to deliver record results in 2022 despite a progressively challenging economic landscape… 2022 was a significant inflection point for our company. It marked the first year where radio no longer comprised the majority of our revenue and profit, further separating Townsquare from our local media peers, and placing a spotlight on our world-class team and our unique and differentiated strategy, assets, platforms and solutions. Our growth engine has been and will continue to be our

2021, Townsquare is upbeat about its Digital segment. CEO Bill Wilson says, “I am proud to report that Townsquare’s transformation into a Digital First Local Media Company allowed us to deliver record results in 2022 despite a progressively challenging economic landscape… 2022 was a significant inflection point for our company. It marked the first year where radio no longer comprised the majority of our revenue and profit, further separating Townsquare from our local media peers, and placing a spotlight on our world-class team and our unique and differentiated strategy, assets, platforms and solutions. Our growth engine has been and will continue to be our  digital solutions, which were the primary driver of our 2022 growth. Total digital revenue increased +16% year-over-year (and +12% in the fourth quarter) to $231 million, and total digital Adjusted Operating Income increased +12% year-over-year to $69 million, representing a 30% profit margin. We believe Townsquare’s ability to drive profitable, sustainable digital growth is a key differentiator for our company, and we reaffirm our expectation that our digital revenue will grow to at least $275 million by 2024. We are uniquely positioned as a Digital First Local Media Company focused principally on markets outside of the Top 50 in the United States, with a resilient digital growth engine supported by both a recurring subscription digital marketing solutions business, with a large addressable market and limited competition, and a highly differentiated digital advertising technology platform. We believe that our business model and strategy position us to weather the current economic environment better than most… Our success has been and will continue to be the result of the Townsquare Team focusing on what we do best: creating high quality, local original content for our audiences and delivering creative and cost-effective marketing solutions for our local clients with strong return on investment.”

digital solutions, which were the primary driver of our 2022 growth. Total digital revenue increased +16% year-over-year (and +12% in the fourth quarter) to $231 million, and total digital Adjusted Operating Income increased +12% year-over-year to $69 million, representing a 30% profit margin. We believe Townsquare’s ability to drive profitable, sustainable digital growth is a key differentiator for our company, and we reaffirm our expectation that our digital revenue will grow to at least $275 million by 2024. We are uniquely positioned as a Digital First Local Media Company focused principally on markets outside of the Top 50 in the United States, with a resilient digital growth engine supported by both a recurring subscription digital marketing solutions business, with a large addressable market and limited competition, and a highly differentiated digital advertising technology platform. We believe that our business model and strategy position us to weather the current economic environment better than most… Our success has been and will continue to be the result of the Townsquare Team focusing on what we do best: creating high quality, local original content for our audiences and delivering creative and cost-effective marketing solutions for our local clients with strong return on investment.” 2022. Salem reports in segments and for the fourth quarter of 2022, net Broadcast revenue increased 4.5% to $53.3 million from $51 million in the same period in 2021. However, Digital media revenue decreased 10.3% to $10.4 million from $11.6 million in Q4 of 2021. The Publishing segment decreased 21.3% to $5.2 million from $6.5 million in the same period a year ago. For the full year of 2022, net Broadcast revenue increased 7.2% to $205.3 million from $191.4 million in 2021. Digital media revenue decreased 1.2% to $41.7 million from $42.2 million, and Publishing revenue decreased 18.9% to $20 million from $24.6 million in 2021. Looking ahead, Salem offers guidance for the first quarter of 2023, saying, “The company is projecting total revenue to be between flat and a decline of 2% from the first quarter 2022 total revenue of $62.6 million.”

2022. Salem reports in segments and for the fourth quarter of 2022, net Broadcast revenue increased 4.5% to $53.3 million from $51 million in the same period in 2021. However, Digital media revenue decreased 10.3% to $10.4 million from $11.6 million in Q4 of 2021. The Publishing segment decreased 21.3% to $5.2 million from $6.5 million in the same period a year ago. For the full year of 2022, net Broadcast revenue increased 7.2% to $205.3 million from $191.4 million in 2021. Digital media revenue decreased 1.2% to $41.7 million from $42.2 million, and Publishing revenue decreased 18.9% to $20 million from $24.6 million in 2021. Looking ahead, Salem offers guidance for the first quarter of 2023, saying, “The company is projecting total revenue to be between flat and a decline of 2% from the first quarter 2022 total revenue of $62.6 million.” $108.3 million for the full year of 2021. Although net income rose almost 16% to $4.27 million in Q4 of 2022, Saga’s net income dipped 17.5% to $9.2 million for the full year of 2022. The company adds, “Despite strong underlying performance the results were impacted by one-time payments during the 3rd quarter related to the passing in August of our founder Ed Christian. As a result of Ed Christian’s passing, the company was required to make several payments to his estate as outlined in his employment agreement. Without these expenses operating income would have increased 12.3% to $16.9 million, free cash flow would have been approximately flat with last year at $13.6 million and net income would have increased 16.8% to $13 million.”

$108.3 million for the full year of 2021. Although net income rose almost 16% to $4.27 million in Q4 of 2022, Saga’s net income dipped 17.5% to $9.2 million for the full year of 2022. The company adds, “Despite strong underlying performance the results were impacted by one-time payments during the 3rd quarter related to the passing in August of our founder Ed Christian. As a result of Ed Christian’s passing, the company was required to make several payments to his estate as outlined in his employment agreement. Without these expenses operating income would have increased 12.3% to $16.9 million, free cash flow would have been approximately flat with last year at $13.6 million and net income would have increased 16.8% to $13 million.” three segments. The Multiplatform Group (including broadcast stations, networks and sponsorships & events) reports Q4 revenue of $732 million – a 0.9% increase over Q4 2021. Broadcast revenue grew $3 million, while Networks declined $5.5 million (4.1%). Revenue from Sponsorship and Events increased by $8.1 million (12.1%). The Digital Audio Group reports revenue of $301 million in Q4 of 2022 – up 10.2%

three segments. The Multiplatform Group (including broadcast stations, networks and sponsorships & events) reports Q4 revenue of $732 million – a 0.9% increase over Q4 2021. Broadcast revenue grew $3 million, while Networks declined $5.5 million (4.1%). Revenue from Sponsorship and Events increased by $8.1 million (12.1%). The Digital Audio Group reports revenue of $301 million in Q4 of 2022 – up 10.2%  over Q4 of ’21. Podcast revenue increased by $16.4 million (16.9%). The Audio & Media Services Group reports Q4 2022 revenue of $94.5 million – an increase of 44.3% over the same period in 2021. iHeartMedia chairman and CEO Bob Pittman says, “We are pleased to report another quarter of solid operating results for iHeart in consumer usage, revenue, and earnings growth. The fourth quarter was our best quarter for Revenue and Adjusted EBITDA – and on a full-year basis, in 2022 we generated the highest revenue and the second highest Adjusted EBITDA and Free Cash Flow year in iHeart’s history. Even in this continuing challenging and uncertain economic environment, we continue to make strong progress in our transformation of iHeart into a true multiplatform audio company – driven by innovation, supported by data and technology, and powered by the largest sales force in audio – and we are positioning iHeart to take advantage of the coming economic recovery.”

over Q4 of ’21. Podcast revenue increased by $16.4 million (16.9%). The Audio & Media Services Group reports Q4 2022 revenue of $94.5 million – an increase of 44.3% over the same period in 2021. iHeartMedia chairman and CEO Bob Pittman says, “We are pleased to report another quarter of solid operating results for iHeart in consumer usage, revenue, and earnings growth. The fourth quarter was our best quarter for Revenue and Adjusted EBITDA – and on a full-year basis, in 2022 we generated the highest revenue and the second highest Adjusted EBITDA and Free Cash Flow year in iHeart’s history. Even in this continuing challenging and uncertain economic environment, we continue to make strong progress in our transformation of iHeart into a true multiplatform audio company – driven by innovation, supported by data and technology, and powered by the largest sales force in audio – and we are positioning iHeart to take advantage of the coming economic recovery.”  full year of 2021. For the full year of 2022, Cumulus’ broadcast radio revenue was basically flat (-0.1%) at $709.6 million and its digital revenue was $142.3 million, an increase of 12.2%. Breaking down the broadcast radio segment, spot revenue was $479.8 million – up 4.9% over 2021 – but network revenue was off 9% for the year at $229.7 million. Cumulus president and CEO Mary G. Berner says, “Despite considerable economic turbulence, we delivered fourth quarter financial performance in the upper half of our guidance range, continuing a multi-year period of significant accomplishments. Operating through a series of difficult macroeconomic environments, including the pandemic, we successfully executed a strategic plan under which we developed and drove new areas of growth, right sized the balance sheet, improved the company’s operating leverage and returned capital to shareholders. As a result, we have delivered consistent revenue growth, built several digital businesses to a $150+ million revenue run-rate, reduced our net leverage to its lowest level in more than a decade, and boosted our liquidity to give ourselves optionality regarding capital allocation.” Looking ahead to 2023, we continue to face substantial economic headwinds. However, our battle-tested skill in performing during challenging times, as well as our very strong financial position, gives us substantial confidence in our ability to not only weather this depressed ad environment but take full advantage of opportunities that may arise over the coming quarters.”

full year of 2021. For the full year of 2022, Cumulus’ broadcast radio revenue was basically flat (-0.1%) at $709.6 million and its digital revenue was $142.3 million, an increase of 12.2%. Breaking down the broadcast radio segment, spot revenue was $479.8 million – up 4.9% over 2021 – but network revenue was off 9% for the year at $229.7 million. Cumulus president and CEO Mary G. Berner says, “Despite considerable economic turbulence, we delivered fourth quarter financial performance in the upper half of our guidance range, continuing a multi-year period of significant accomplishments. Operating through a series of difficult macroeconomic environments, including the pandemic, we successfully executed a strategic plan under which we developed and drove new areas of growth, right sized the balance sheet, improved the company’s operating leverage and returned capital to shareholders. As a result, we have delivered consistent revenue growth, built several digital businesses to a $150+ million revenue run-rate, reduced our net leverage to its lowest level in more than a decade, and boosted our liquidity to give ourselves optionality regarding capital allocation.” Looking ahead to 2023, we continue to face substantial economic headwinds. However, our battle-tested skill in performing during challenging times, as well as our very strong financial position, gives us substantial confidence in our ability to not only weather this depressed ad environment but take full advantage of opportunities that may arise over the coming quarters.” “Operating loss, net loss and net loss per diluted share for the three months ended December 31, 2022 include $44.2 million of non-cash impairment losses related to FCC licenses, goodwill and franchise rights. Operating loss, net loss and net loss per diluted share for the 12 months ended December 31, 2022 include $54.7 million of non-cash impairment losses related to FCC licenses, goodwill and franchise rights.” Beasley CEO Caroline Beasley comments, “Beasley’s 2022 fourth quarter and full-year financial results reflect the ongoing success of our digital transformation and revenue diversification strategies, which drove year-over-year increases in revenue and SOI for both the three- and 12-month periods. Throughout the year, Beasley largely offset ongoing challenges related to the economy and softness in the national spot market, as we generated healthy growth across all of our digital, local audio, political and other revenue sources, as reflected by the 6.2% increase in full year net revenues to $256 million. This top-line growth was

“Operating loss, net loss and net loss per diluted share for the three months ended December 31, 2022 include $44.2 million of non-cash impairment losses related to FCC licenses, goodwill and franchise rights. Operating loss, net loss and net loss per diluted share for the 12 months ended December 31, 2022 include $54.7 million of non-cash impairment losses related to FCC licenses, goodwill and franchise rights.” Beasley CEO Caroline Beasley comments, “Beasley’s 2022 fourth quarter and full-year financial results reflect the ongoing success of our digital transformation and revenue diversification strategies, which drove year-over-year increases in revenue and SOI for both the three- and 12-month periods. Throughout the year, Beasley largely offset ongoing challenges related to the economy and softness in the national spot market, as we generated healthy growth across all of our digital, local audio, political and other revenue sources, as reflected by the 6.2% increase in full year net revenues to $256 million. This top-line growth was  the primary factor contributing to a 2.8% year-over-year increase in full year SOI to $43.1 million. While economic uncertainty remains, Beasley initiated several actions throughout the year that we believe will strengthen the long-term position of our business. First, our digital strategy continues to deliver strong results with fourth quarter digital revenue growth of 13.2% year-over-year, representing nearly 17% of total fourth quarter revenue. Digital revenue has consistently outpaced national spot advertising revenue over the past several quarters due to a combination of organic growth and contributions from the second quarter acquisition of our white label digital agency business, Guarantee Digital. With accelerating demand from consumers and advertisers for our local content and multi-platform marketing solutions, we are solidly on the path for this revenue source to reach 20% of total revenue. Second, we remain focused on monetizing our premium audio and digital content through new local business development, revenue diversification and maximizing political revenue opportunities. As a result, in the fourth quarter, we delivered $5.1 million in net political revenue, with stronger than expected gains in Las Vegas, Philadelphia, and Detroit, as well as year-over-year total revenue increases across nearly all of our markets and in our esports business. Our radio brands remain dominant in Nielsen Audio ratings, where Beasley currently has the highest average cluster share when compared to the major radio broadcasters in PPM. Finally, we implemented a cost reduction program in the second half of 2022, with the majority of cost cuts occurring in October.”

the primary factor contributing to a 2.8% year-over-year increase in full year SOI to $43.1 million. While economic uncertainty remains, Beasley initiated several actions throughout the year that we believe will strengthen the long-term position of our business. First, our digital strategy continues to deliver strong results with fourth quarter digital revenue growth of 13.2% year-over-year, representing nearly 17% of total fourth quarter revenue. Digital revenue has consistently outpaced national spot advertising revenue over the past several quarters due to a combination of organic growth and contributions from the second quarter acquisition of our white label digital agency business, Guarantee Digital. With accelerating demand from consumers and advertisers for our local content and multi-platform marketing solutions, we are solidly on the path for this revenue source to reach 20% of total revenue. Second, we remain focused on monetizing our premium audio and digital content through new local business development, revenue diversification and maximizing political revenue opportunities. As a result, in the fourth quarter, we delivered $5.1 million in net political revenue, with stronger than expected gains in Las Vegas, Philadelphia, and Detroit, as well as year-over-year total revenue increases across nearly all of our markets and in our esports business. Our radio brands remain dominant in Nielsen Audio ratings, where Beasley currently has the highest average cluster share when compared to the major radio broadcasters in PPM. Finally, we implemented a cost reduction program in the second half of 2022, with the majority of cost cuts occurring in October.”  increase of 348,000 for the year, aided by a growing base of streaming-only subscribers. Net income for Q4 of 2022 was $365 million, up from the $318 million posted in Q4 of 2021. For the year, net income was $1.2 billion, down from the $1.3 billion reported in 2021. CEO Jennifer Witz says, “2022 was a strong year for SiriusXM, as we continued to focus on bringing consumers the best in audio entertainment both in-car and on the go, reaching record high revenue and record low churn. Our strong operating and financial performance in 2022 are a testament to our resilient business model and growing contribution from streaming, which helped us deliver 348,000 net new self-pay subscribers. In 2023, we expect SiriusXM to deliver strong operating performance and generate significant cash, even as we face a challenging economic environment and continue to make material investments in our technology infrastructure.”

increase of 348,000 for the year, aided by a growing base of streaming-only subscribers. Net income for Q4 of 2022 was $365 million, up from the $318 million posted in Q4 of 2021. For the year, net income was $1.2 billion, down from the $1.3 billion reported in 2021. CEO Jennifer Witz says, “2022 was a strong year for SiriusXM, as we continued to focus on bringing consumers the best in audio entertainment both in-car and on the go, reaching record high revenue and record low churn. Our strong operating and financial performance in 2022 are a testament to our resilient business model and growing contribution from streaming, which helped us deliver 348,000 net new self-pay subscribers. In 2023, we expect SiriusXM to deliver strong operating performance and generate significant cash, even as we face a challenging economic environment and continue to make material investments in our technology infrastructure.” indicates that #2 genre was Society & Culture (up from #3 in Q2 2022); #3 was News (down from #2 in Q2 2022), followed by True Crime at #4, Sports at #5, Business at #6, Arts at #7, History at #8 (up from #11 in Q2 2022), Religion & Spirituality at #9 (up from #10 in Q2 2022) and Education at #10 (down from #9 in Q2 2022). Podcasts are classified according to the self-identified genre submitted by the podcast to Apple Podcast API. Nineteen genres are identified as having at least one percent reach among those in the U.S. age 18+ for Q3 2022.

indicates that #2 genre was Society & Culture (up from #3 in Q2 2022); #3 was News (down from #2 in Q2 2022), followed by True Crime at #4, Sports at #5, Business at #6, Arts at #7, History at #8 (up from #11 in Q2 2022), Religion & Spirituality at #9 (up from #10 in Q2 2022) and Education at #10 (down from #9 in Q2 2022). Podcasts are classified according to the self-identified genre submitted by the podcast to Apple Podcast API. Nineteen genres are identified as having at least one percent reach among those in the U.S. age 18+ for Q3 2022.