BIA Advisory Reduces Predicted 2024 U.S. Ad Spend

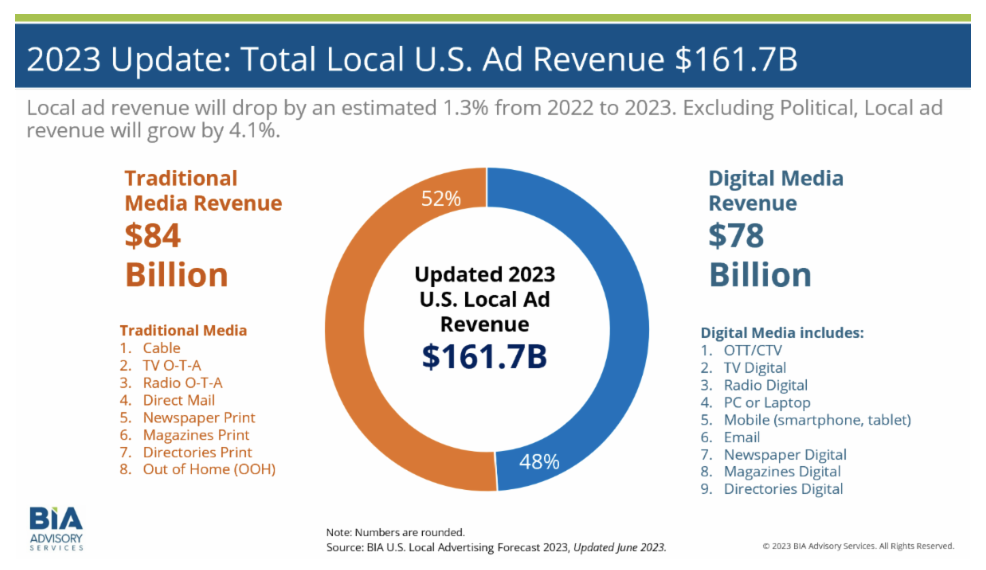

BIA Advisory Services updates its 2024 U.S. Local Advertising Forecast, estimating revenue across all media in the U.S. will reach $172 billion in 2024, an increase of 9.3 percent over 2023. This revision is a reduction of 2% from the forecast published last October. BIA Advisory says the rise will be driven by local political and other key local vertical ad spend, and significant ad growth for connected TV/over-the-top (CTV/OTT), TV OTA, and TV Digital. BIA VP of forecasting & analysis Nicole Ovadia states, “As expected, local political advertising will be substantial this year, and it’s fueling spend across the media landscape. Our slight adjustment down for this year is mainly due to mixed economic signals, a slowdown in certain consumer purchases, and lower than expected spending in Digital and Direct Mail advertising at the end of 2023 that may flow into this year. However, we still anticipate 2024 to be better for local advertising than 2023 and certain media like TV OTA, TV Digital, and CTV/OTT are growing substantially.”

local political and other key local vertical ad spend, and significant ad growth for connected TV/over-the-top (CTV/OTT), TV OTA, and TV Digital. BIA VP of forecasting & analysis Nicole Ovadia states, “As expected, local political advertising will be substantial this year, and it’s fueling spend across the media landscape. Our slight adjustment down for this year is mainly due to mixed economic signals, a slowdown in certain consumer purchases, and lower than expected spending in Digital and Direct Mail advertising at the end of 2023 that may flow into this year. However, we still anticipate 2024 to be better for local advertising than 2023 and certain media like TV OTA, TV Digital, and CTV/OTT are growing substantially.”

billion in total local advertising, only a 2.2% increase in local advertising year-over-year.” BIA VP of forecasting & analysis Nicole Ovadia adds, “As expected, 2024 will be driven by political spending, and, even in markets that are not highly contested there will be a large amount of political advertising. Local political advertising will be fueled by the presidential and senate campaigns as well as issue-based advertising. When we look at the forecast without political, we expect only a slight increase in ad spending due to both global and local economic trends that may create more cautious spending.”

billion in total local advertising, only a 2.2% increase in local advertising year-over-year.” BIA VP of forecasting & analysis Nicole Ovadia adds, “As expected, 2024 will be driven by political spending, and, even in markets that are not highly contested there will be a large amount of political advertising. Local political advertising will be fueled by the presidential and senate campaigns as well as issue-based advertising. When we look at the forecast without political, we expect only a slight increase in ad spending due to both global and local economic trends that may create more cautious spending.”